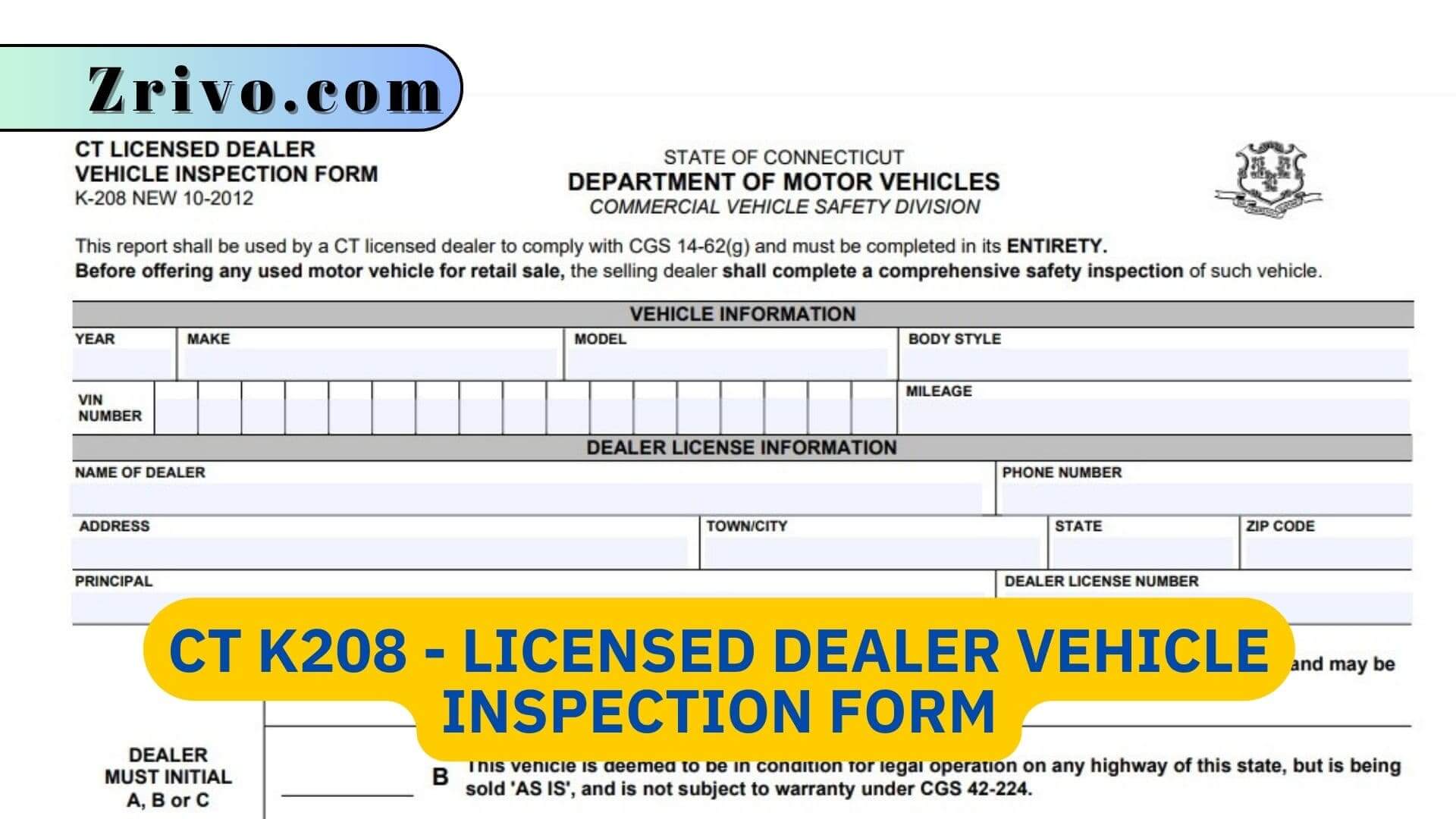

CT K208 – Licensed Dealer Vehicle Inspection Form

In addition to the basic information on the car, the form also requires the dealer to check a number of boxes indicating the status of various components of the vehicle. This includes the engine, transmission, and brakes. The dealer must also note whether the vehicle is being sold “as is” or with a warranty. In … Read more