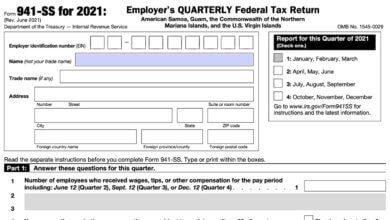

941 Forms

Employer’s Quarterly Tax Return, Form 941 is the return that reports income paid to employees and tax withheld to the IRS. Get the 941 Forms for every quarter and fill out online.

-

941 Instructions

941 Instructions: A Comprehensive Guide The 941 form, commonly referred to as the Employer’s Quarterly Federal Tax Return, is a…

-

941 Form 2025 - 2026

941 form: What is it? IRS Form 941 is a federal payroll tax form that employers must file quarterly to…

-

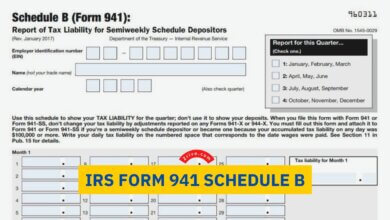

IRS Form 941 Schedule B

Generally, Form 941 Schedule B is used in conjunction with Form 941 to report employee wages and taxes. This is…

-

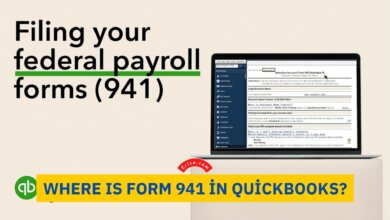

Where Is Form 941 in Quickbooks?

If you are new to Quickbooks, then it may be a challenge to find Form 941. You can even start to think…

-

Form 944 Mailing Address 2025 - 2026

Not all employers are required to file Form 941 for every quarter if the taxes withheld is less than $1,000…

-

941-SS 2025 - 2026

Form 941, Employer’s Quarterly Federal Tax Return, is the tax form used for reporting wages paid, Social Security, Medicare, and…

-

941 Form Mailing Address

Form 941, the tax form used for reporting payroll-related taxes is known as the Employer’s Quarterly Tax Return. Employers in…

-

Where to File Form 941?

Where to File Form 941—Employer’s Quarterly Federal Tax Return? The Internal Revenue Service requires employers to file Form 941 for…