Sales Tax

Sales tax rates for all states. Find out what portişon of your purchases goes towards taxes.

-

Ohio Sales Tax Holiday 2025 - 2026

If you’re in Ohio and looking to score big savings on back-to-school shopping or other qualifying purchases, the Ohio Sales…

-

Depop Sales Tax: How It Works for Sellers and Shoppers

Depop sales tax is a hot topic for every seller on this popular resale platform, especially as tax laws and…

-

Do Veterans Pay Sales Tax?

“Do Veterans Pay Sales Tax?”. When it comes to the question of whether veterans pay sales tax, the answer can…

-

Does Facebook Marketplace Charge Tax?

If you’ve ever sold or bought something on Facebook Marketplace, you’ve probably asked yourself, “Does Facebook Marketplace charge tax?” The…

-

New York Sales Tax Registration Guide

Sales tax registration is a critical step for any business that plans to sell taxable goods or services in New…

-

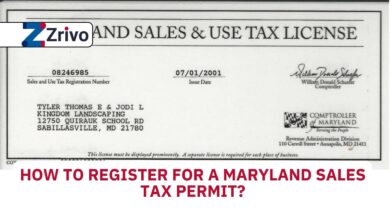

How to Register for a Maryland Sales Tax Permit?

Registering for a sales tax permit in Maryland is an essential step for businesses that plan to sell taxable goods…

-

How to Register a Business in Pennsylvania?

Registering a business in Pennsylvania involves several essential steps, including choosing a business structure, registering your business name, obtaining an…