State and Local Taxes

Most states impose a state income tax just like the federal income taxes but at a lower rate. Learn everything about your state income taxes.

Check out more in State and Local Taxes

-

Ohio Sales Tax Holiday 2025 - 2026

If you’re in Ohio and looking to score big savings on back-to-school shopping or other qualifying purchases, the Ohio Sales…

-

Jackson County Property Tax

Navigating the intricacies of Jackson County property tax is crucial for homeowners and prospective buyers alike. Understanding how property taxes…

-

Union Dues Tax Deduction: Who Qualifies and How to Claim

If you’ve ever stared at your pay stub and wondered, Can I claim union dues on my taxes?—you’re not alone.…

-

How Inheritance Tax Works for Minor Recipients

When it comes to the topic of Minor Recipient Inheritance Tax in the United States, things can get confusing fast-especially…

-

Depop Sales Tax: How It Works for Sellers and Shoppers

Depop sales tax is a hot topic for every seller on this popular resale platform, especially as tax laws and…

-

Nebraska Savings 529: Your Pathway to Smart College Savings

When it comes to planning for future education expenses, the Nebraska Savings 529 plan stands out as an excellent option…

-

Do Veterans Pay Sales Tax?

“Do Veterans Pay Sales Tax?”. When it comes to the question of whether veterans pay sales tax, the answer can…

-

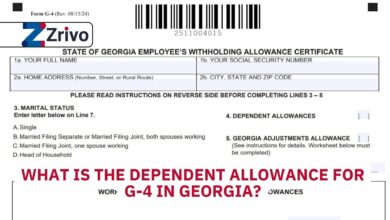

What Is the Dependent Allowance for G-4 in Georgia?

The dependent allowance for G-4 in Georgia is a key component of the state’s income tax withholding system, allowing employees…