IRS Forms

Internal Revenue Service tax documents and forms. Get the tax forms that you need to file your taxes and perform your duties.

Check out more in IRS Forms

-

Where to File Form 1120-C?

Filing taxes as a cooperative association can be a maze of forms, deadlines, and IRS addresses—but knowing exactly where to…

-

Form 8888 Instructions 2025 - 2026

IRS Form 8888, officially titled “Allocation of Refund,” allows taxpayers to split their federal income tax refund into multiple accounts…

-

Where Do I Mail My Form 12153 To?

When dealing with IRS collection actions, understanding the process for requesting a Collection Due Process (CDP) hearing is crucial. This…

-

What Happens if I Lose My 1099?

Losing your 1099 form can feel stressful, especially when tax season is approaching. This form is crucial for reporting income…

-

How to Fill Out Form 8958?

Form 8958 is designed for individuals who are subject to community property laws and file separate federal income tax returns.…

-

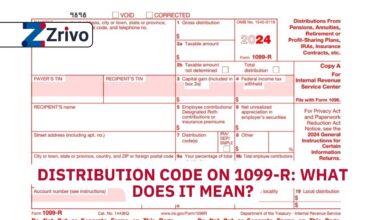

Distribution Code on 1099-R: What Does It Mean?

Understanding the Distribution Code on 1099-R is crucial for anyone involved with retirement accounts, pensions, or annuities. Form 1099-R is…

-

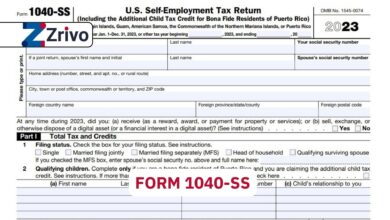

Form 1040-SS 2025 - 2026

IRS Form 1040-SS, officially titled “U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of…

-

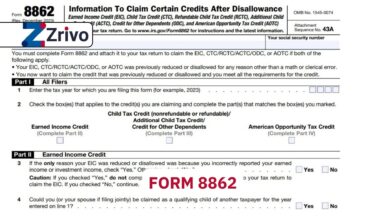

Form 8862 2025 - 2026

Taxes can be complex, especially when it comes to claiming credits that reduce your tax liability. Sometimes, the IRS may…