W-2 Forms

Employers, use Form W-2, Wage and Tax Statement to report income paid to employees and taxes withheld.

-

W-2C Form 2025 - 2026

Tax season can be a daunting time, but it’s essential to ensure your financial records are accurate. The W-2C form…

-

W-2G Form 2025 - 2026

Gambling can be a thrilling pastime, and for some, it can be quite lucrative. However, when it comes to reporting…

-

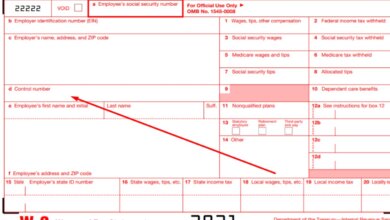

W2 Form 2025 - 2026

The W2 Form is used to report how much income tax you have paid to the government. This includes the federal…

-

TurboTax W2 Finder

Whether you’re filing your taxes yourself or using a tax preparer, you may need to get a copy of your…

-

Form W2 Changes for

Are there any changes to Form W4 for the tax season? It’s a normal reaction if you’re wondering whether there…

-

W2 Form Instructions 2025 - 2026 to File

Form W2, Wage and Tax Statement is the same as it was last year. The Internal Revenue Service didn’t bring…

-

W-2 Control Number

Form W-2, Wage and Tax Statement includes many information about an employee’s payroll. The Internal Revenue Service wants employers to…

-

What is Box 14 on W-2

Form W-2 is the Wage and Tax Statement every employer needs to file for each employee. When filing the form,…

-

How to request Form W-2 from employer

For an employee to file her or his federal income tax return, the necessary information returns are needed to report…

-

W-2 Mate 2025 - 2026

Form W-2 mate is issued by Real Tax Tools that employers can file to furnish electronic copies to employees that…