IRS

The Internal Revenue Service tax reforms and news for individual and business taxes. Use tools brought to you by the IRS to ease the burden of taxes.

Check out more in IRS

-

Does the IRS Work on Weekends?

If you’ve ever found yourself wondering, does the IRS work on weekends? you’re not alone. Many taxpayers are curious about…

-

How Long Can the IRS Hold Your Refund for Review?

If you’ve ever been eagerly waiting for your tax refund, only to find out that the IRS has delayed it…

-

How Does The IRS Verify Child Dependent Care: What You Need to Know

If you’re wondering how the IRS verifies child dependent care, you’re not alone! The IRS verification process for child dependent…

-

Does 1231 Override 1245?

When it comes to the tax treatment of business property gains, many taxpayers wonder, “does 1231 override 1245?” The simple…

-

Can I Write off Credit Card Annual Fees: A Complete Guide

If you’ve ever sighed at your credit card statement and asked, “Can I write off credit card annual fees?”—you’re definitely…

-

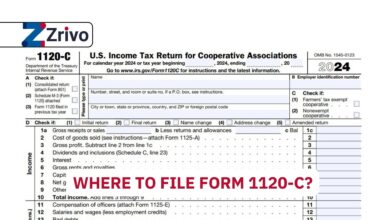

Where to File Form 1120-C?

Filing taxes as a cooperative association can be a maze of forms, deadlines, and IRS addresses—but knowing exactly where to…

-

Can You Make Your Parent Drop You as a Dependent?

“Can you make your parent drop you as a dependent?” That’s a question more and more young adults are asking…

-

I Lost My ITIN Number, What Do I do?

Losing your ITIN number can be stressful, especially when you realize it’s essential for tax filings and other financial matters.…