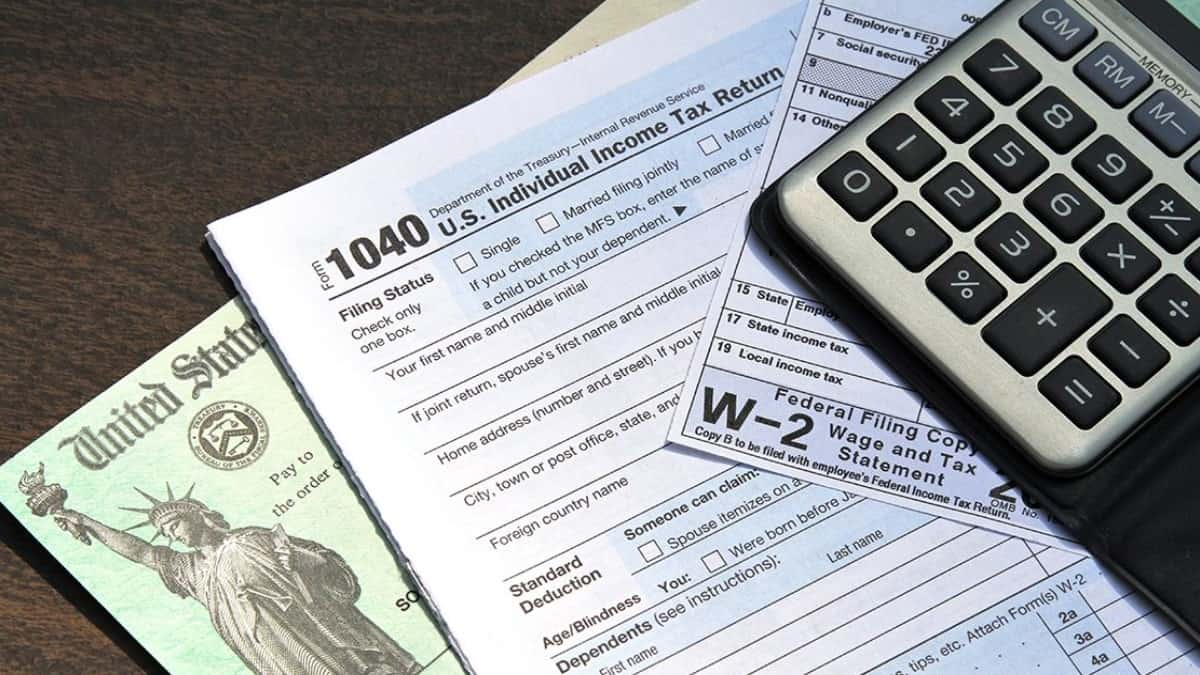

W-2 Explanation

A W-2 explanation is essential for anyone working for an employer. It will help you to know the information on the document, as well as how to correct any mistakes you make. This article will walk you through some of the most common mistakes to avoid on a W-2. Box 1 Box 1 on your … Read more