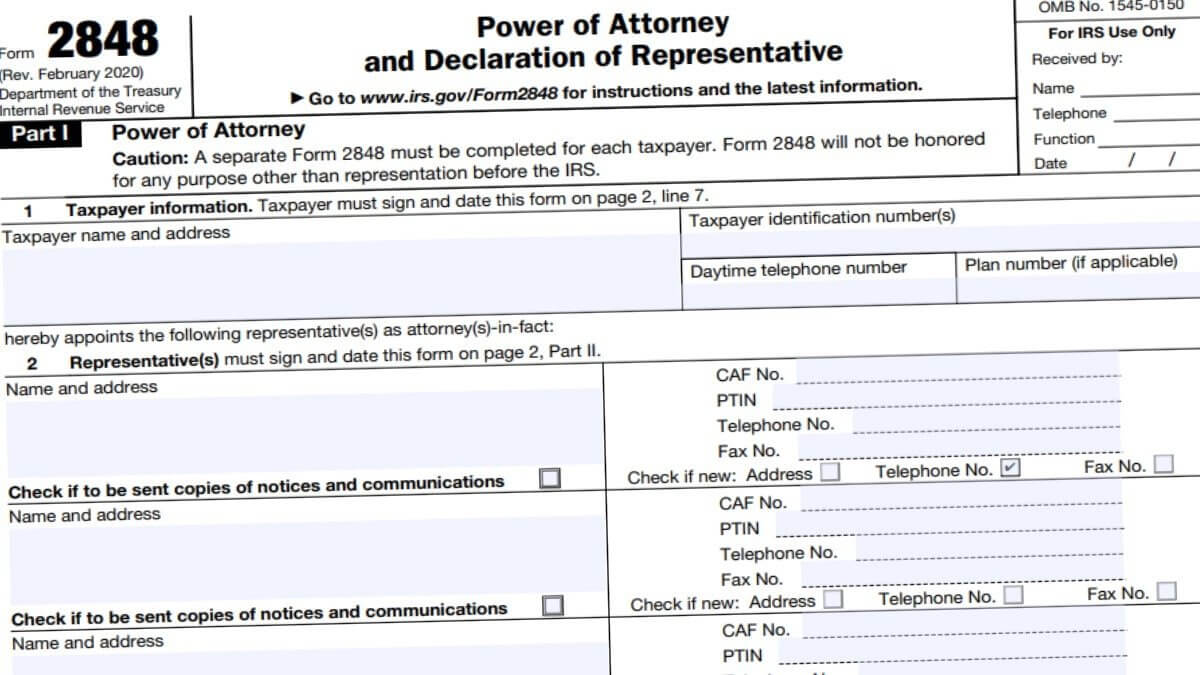

2848 Form

Form 2848—Power of Attorney and Declaration of Representative is the IRS form where individuals can authorize someone else to represent them before the IRS. This tax form is mostly used for giving authorization to attorneys but can be filled out to give authorization to anyone. Since the purpose of Form 2848 is very simple, the … Read more