Tax Season Postponed by the IRS

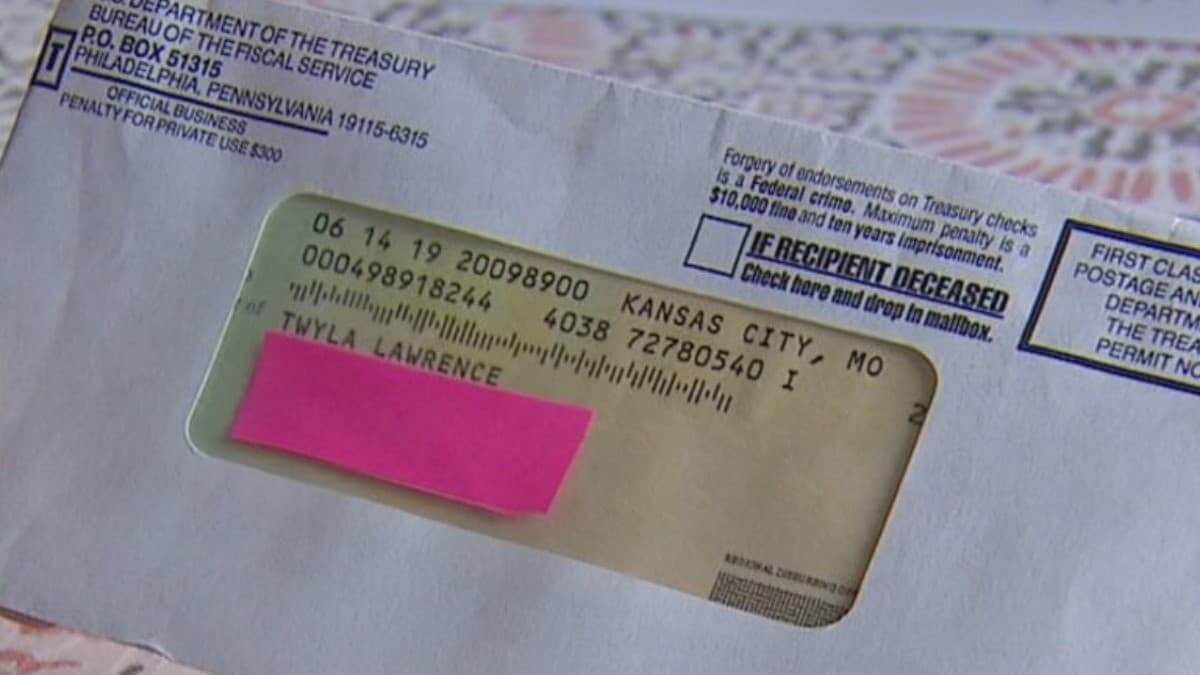

The Internal Revenue Service announced when the agency will start accepting tax returns. After the second economic impact payments were sent out by the Department of Treasury and the Internal Revenue Service, it was expected that the start of the tax season would be at a later date than normal. For the tax season – … Read more