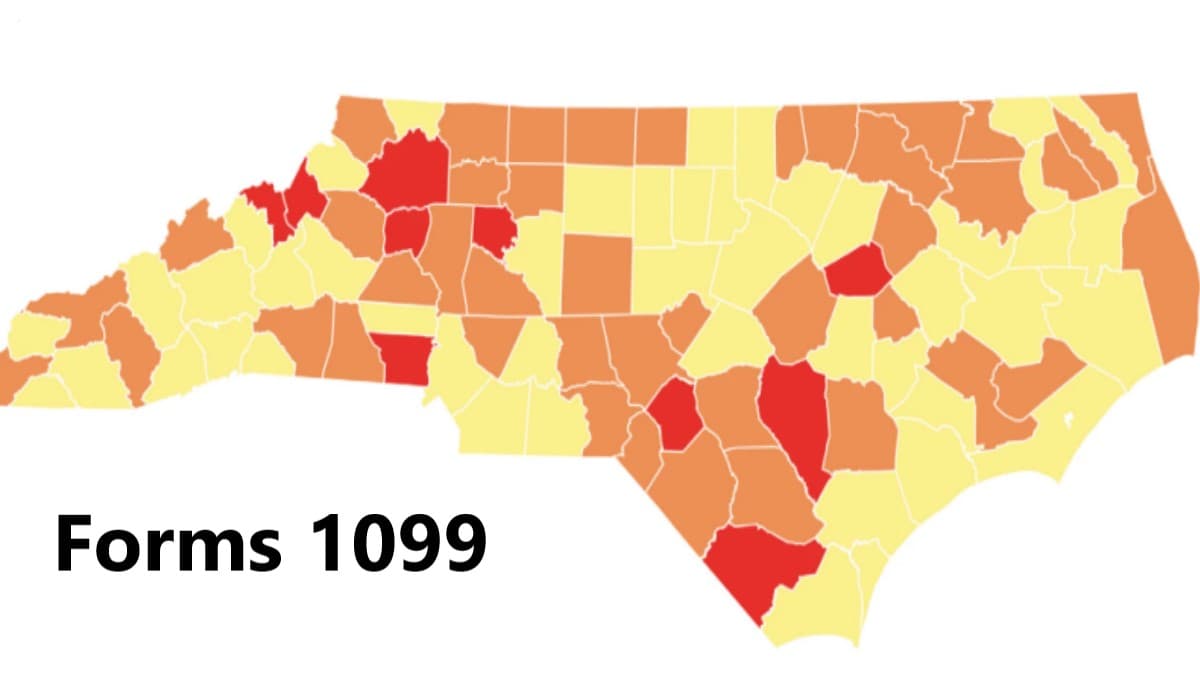

1099 Filing Requirements

Forms 1099 are information returns that report income paid to individuals and businesses in a wide variety of ways. The Internal Revenue Service requires taxpayers to file the accurate Form 1099 depending on the type of payment made and the amount. If the payment exceeds a certain amount (for example, it’s $600 for Form 1099-MISC), … Read more