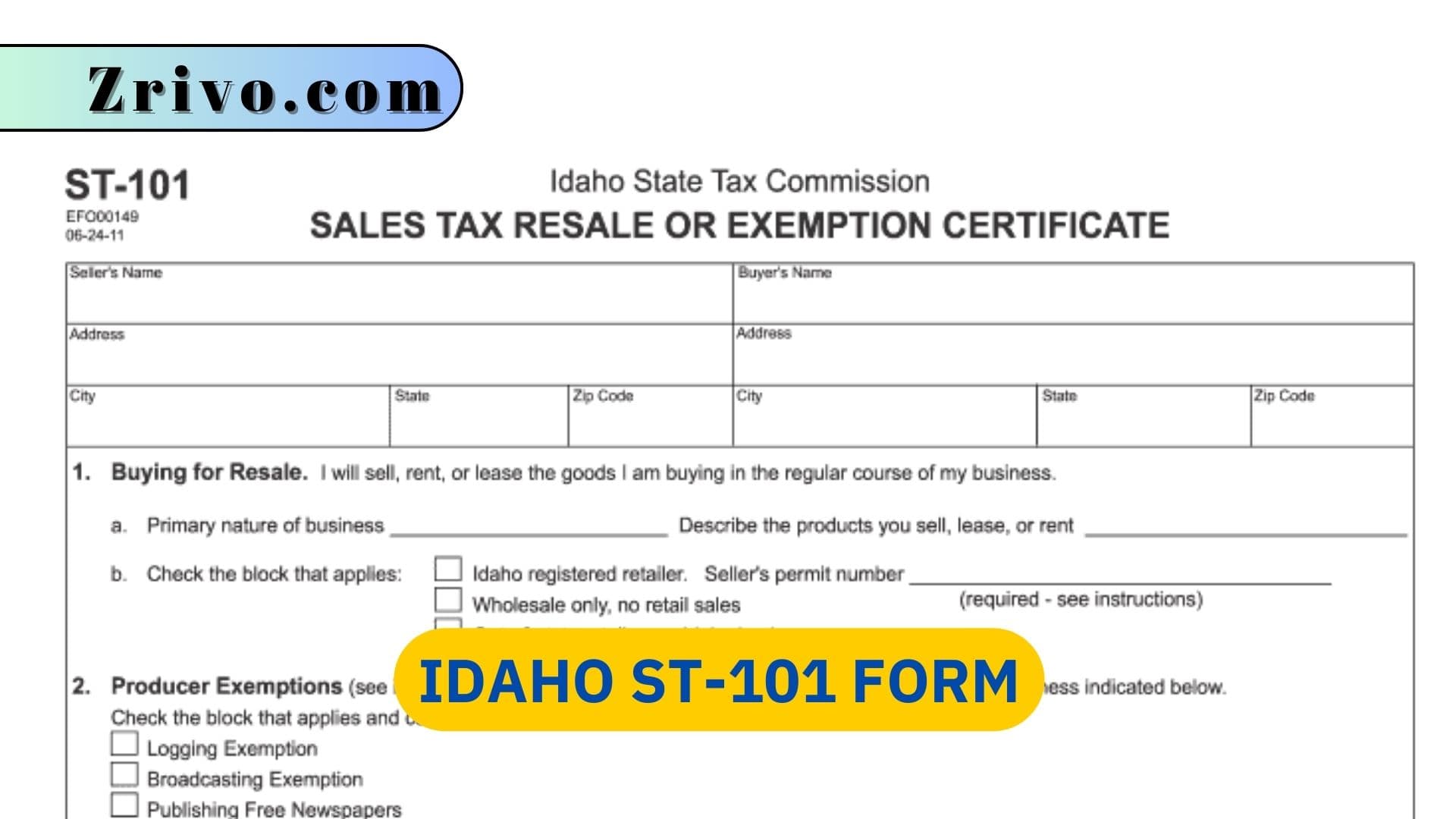

Idaho ST-101 Form 2025 - 2026

Businesses that sell tangible personal property or provide taxable services in the state of Idaho must file Idaho Form ST-101. The form provides information about taxable sales and use taxes that are owed by the business. Generally, the form requires basic business information, including the legal name, address, EIN, and the reporting period (monthly, quarterly, … Read more