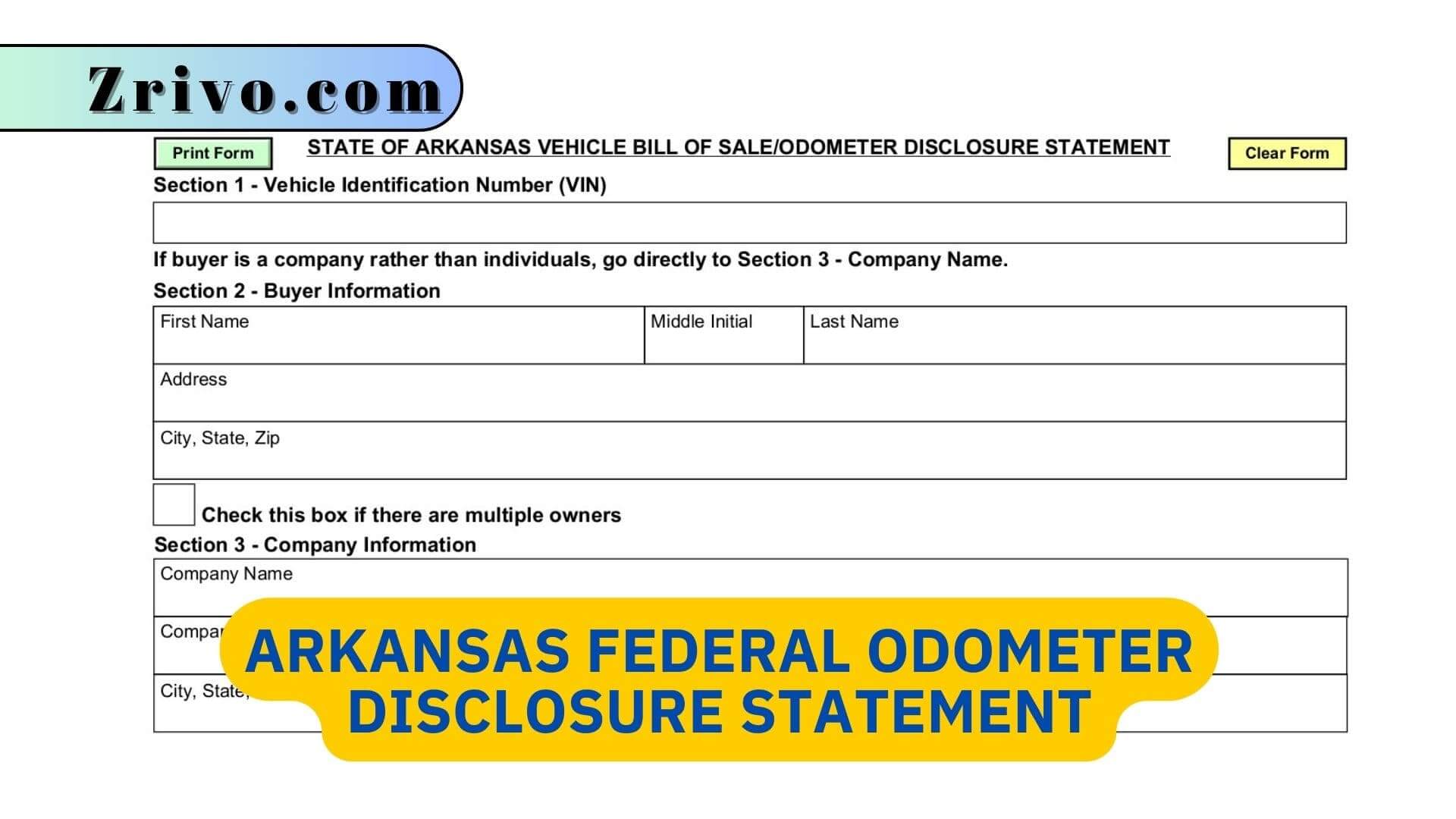

Arkansas Federal Odometer Disclosure Statement

If you plan to sell or transfer a vehicle in Arkansas, getting an odometer statement for the car is important. This is a document that provides a record of the current mileage on the car, and it can help protect you from fraud and other violations. Odometer statements are typically required by law in many … Read more