IRS Data Retrieval Tool for FAFSA

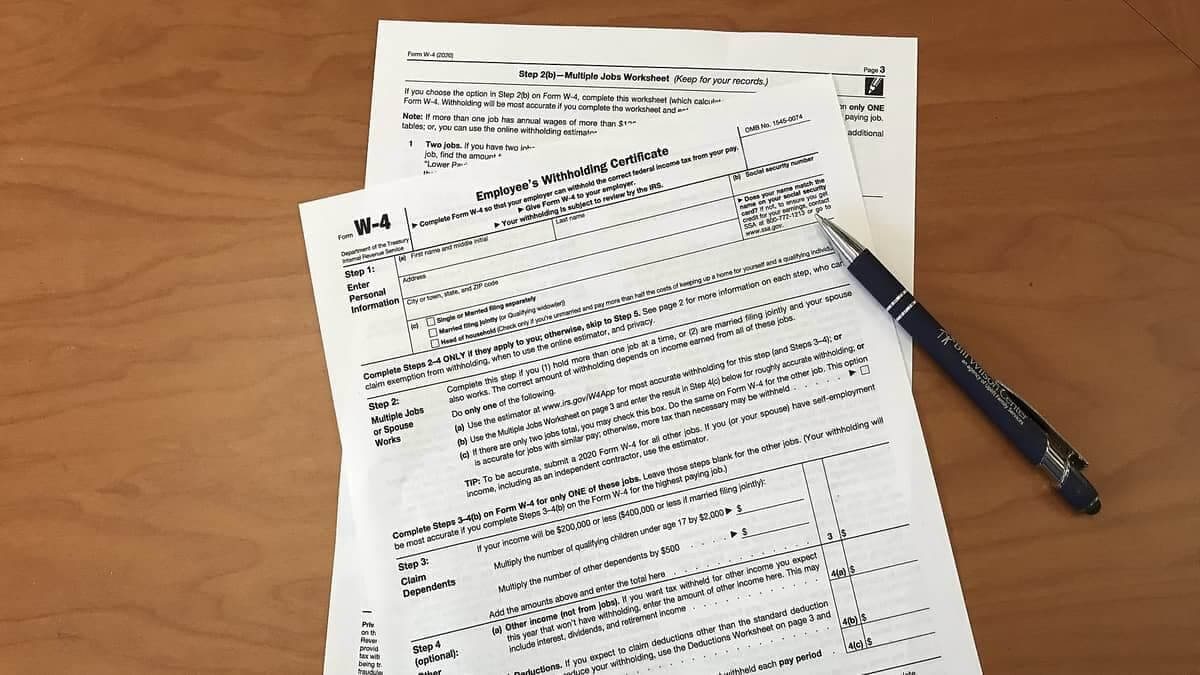

The parents of students that are applying for Federal Student Aid are required to submit their tax information. On a paper application, parents can include their tax transcript on their FAFSA. This is done physically by taking a paper copy of the tax transcript and attaching it to their FAFSA forms. While this is one … Read more