When are Q2 estimated taxes due?

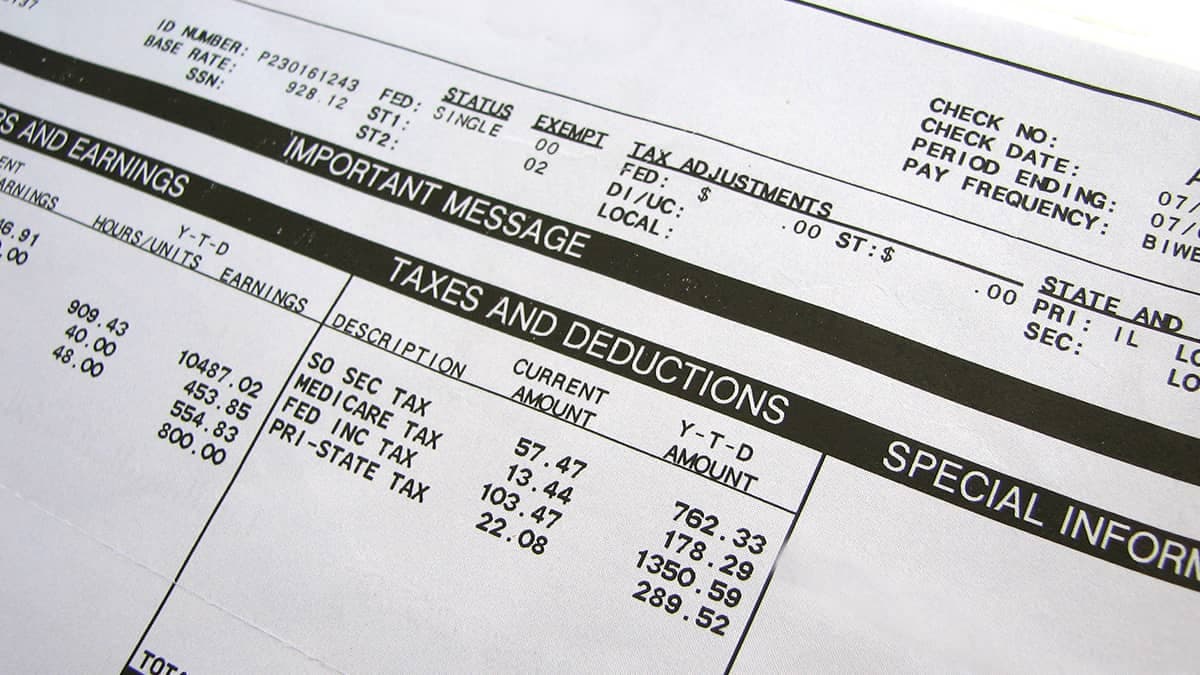

The second quarter’s estimated taxes marks the start of the second half of the tax year. When the second quarter ends, you have 15 days to pay your estimated taxes. If not paid on time, you’ll be hit with late-payment fees and there will be a lot of extra hustle and bustle, which shouldn’t be … Read more