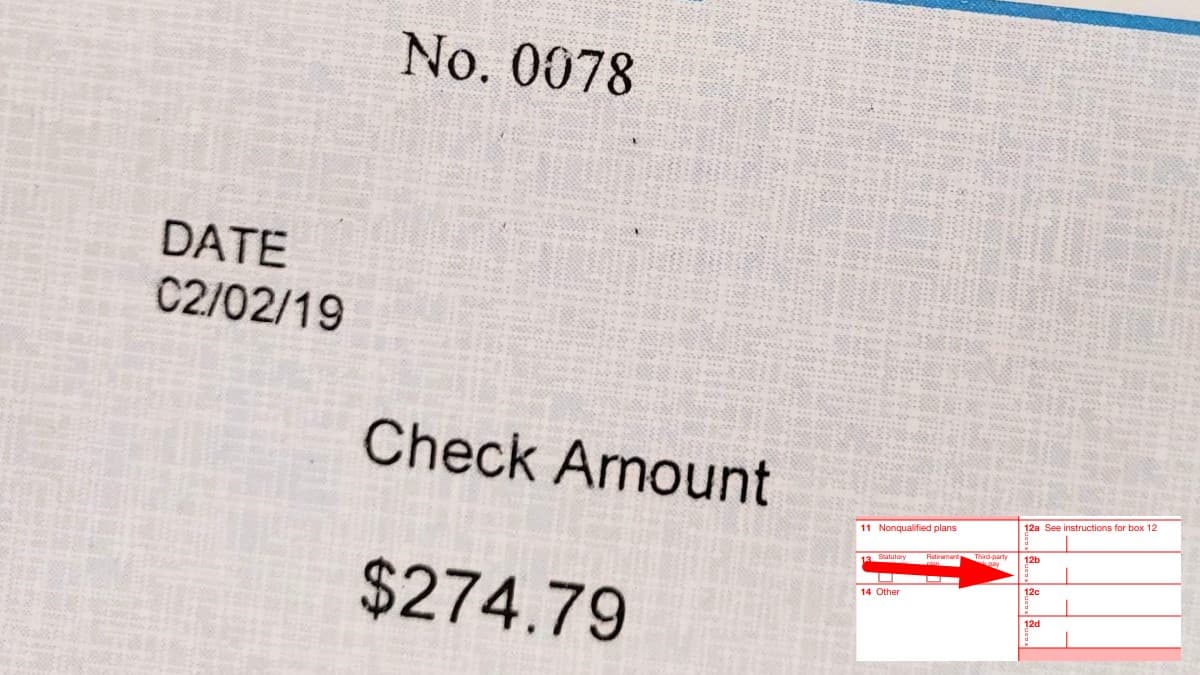

1099-SA Form 2025 - 2026

Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA is the tax form for reporting the distributions above. It’s an information return that’s a part of the other Forms 1099. Although the distributions reported with Form 1099-SA aren’t taxable at all times, it’s still required on Form 1040 when the filer prepares … Read more