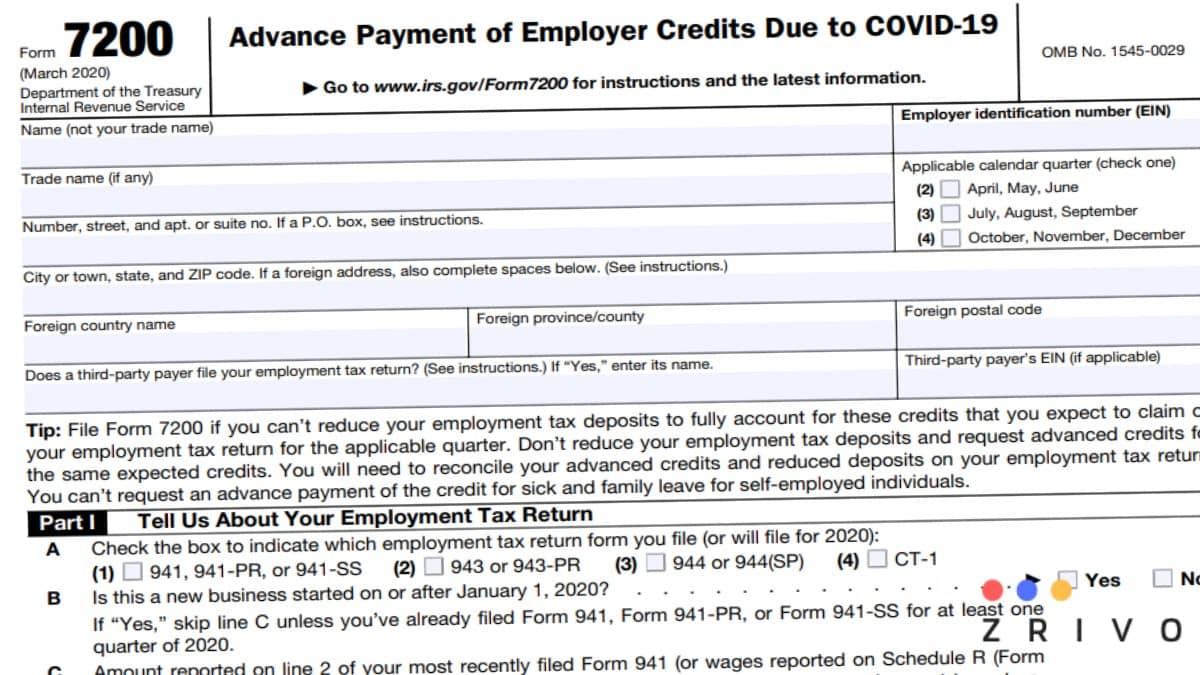

IRS Form 7200 2025 - 2026

IRS Form 7200—Advance Payment of Employer Credits Due to COVID-19 is to request an advance payment of tax credits for qualified family leave wages, sick pay, and employee retention credit. File Form 7200 to request advance payment for the above that you will claim in the following IRS tax forms. For Puerto Rico, file Form … Read more